Life After COVID-19? How Interior Design will Change

-

-

-

- Metals such as copper, brasses, and bronzes are natural antimicrobial materials that have intrinsic properties to destroy a wide range of microorganisms. Not only are these metals hygienic, but they are great accents to warm up your home.

- A separate “casita” or guest house suite can be useful for isolating someone that may be ill, or to provide more distance and privacy for guests.

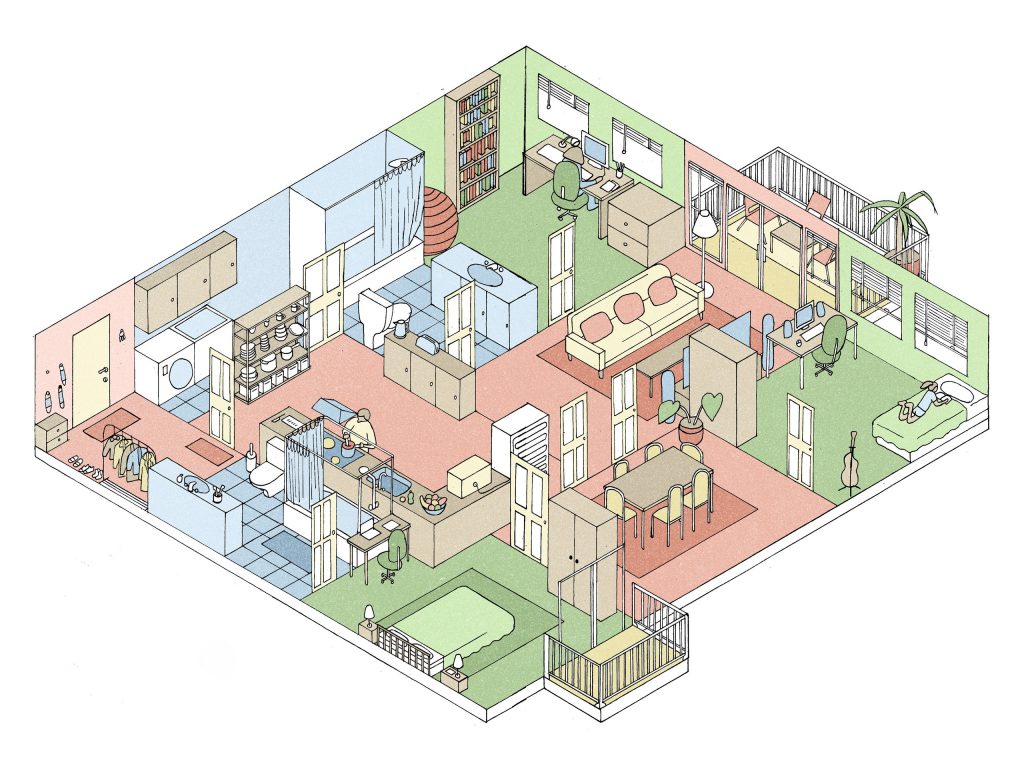

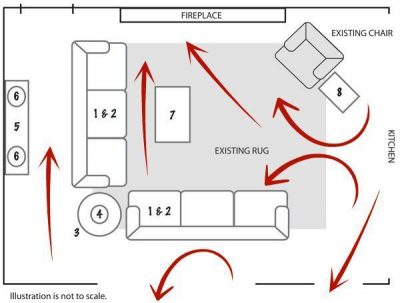

- Office spaces and study areas are more necessary than ever. As more of us work (and learn) from home, a dedicated office and space for studying is essential. Many of us quickly had to convert areas and rooms to our own home offices – showing us the importance of a separate space. Homes with multiple areas for getting work done – offices, libraries, and study areas – will be even more popular in design.

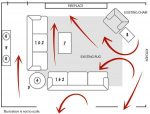

- Multiple areas for activities and entertainment, such as home gyms, media rooms, and game rooms will be necessary to keep everyone entertained. During this pandemic, we have found ourselves with a lot of time on our hands, so whether it’s a family game night or a workout, the need for a space for everyone at home has only increased.

- There’s no doubt that the future of kitchen design will look different in a post COVID 19 world. First, we have been forced to alter the way we shop, store, and prepare food. Second, we have more time at home to get organized, tackle lingering projects, and sanitize our homes. Finally, we have had to change the way we interact and socialize with family, friends, and colleagues. More long term storage and larger freezer capacity are in demand. New kitchens will be designed with cleanability in mind. Low maintenance cabinet finishes, faucets, tile, and fixtures will be a top priority. Quartz is one of the hardest non-precious stones on earth, therefore countertops made from quartz are hard, stain and scratch-resistant, and the most sanitary.

-

-

Our living spaces greatly influence our physical health – as well as our emotional state of mind (especially during his time). So it will continue to be important to create environments that stimulate our senses in a good way, improve relaxation, and have health and wellness benefits to the people using them. Here are a few ways of living that will be popular.

- Bringing in nature will be emphasized in many different ways. From larger windows with views outside and using colors that reflect the natural world. Having lots of greenery in a home is also an obvious and easy stimulant to our overall wellbeing (along with lots of health benefits).

- An increase in organization. Being quarantined at home makes us realize what is really necessary. Clutter can cause anxiety and discomfort – feelings that are more unwanted than ever. Organization will be emphasized, through de-cluttering, smart storage, and built-in shelving and spaces for keeping items organized in smaller spaces.

- A sense of security and calm will definitely be present in interiors. When the world is full of uncertainty, having a space that feels like an escape from the outside world, with soft and cozy materials, light colors and relaxing vibes, will be a prerequisite of design.

When it comes to colors this year, we’re seeing the return of earth tones in a wide spectrum, from cream to terra cotta. Expect to see decor that conveys softness, with plenty of light colors, especially pinks, beiges and other neutral tones, for a Zen look promoting rest, tranquility and well-being.

Nature continues its influential role in the world of decor. Vegetal hues have been in the spotlight for several seasons now, and this year we saw a lot of them, ranging from tender green to intense mint to peacock blue. Sky blue has brightened up the pastel palette.

Earth tones aren’t the only trend with staying power of late. While black is becoming less popular, blue has been replacing it. It’s a more versatile and emotionally indulgent hue well suited to sheltering at home.

Kim N. Bregman

Kim N. Bregman