Blog

August 5, 2023

Are you a home buyer in Florida looking to save money on your insurance costs? Here are some expert tips to help you reduce your home and wind insurance expenses.

Shop Around: Don’t settle for the first insurance quote you receive. Take the time to compare prices from multiple insurers. By doing so, you can find the best coverage at the most competitive rates.

Increase Deductibles: Consider raising your deductibles to lower your premium. While this means you’ll pay more out of pocket in the event of a claim, it can significantly reduce your monthly insurance costs. Make sure you take…

July 20, 2023

Because the builder’s agent’s job is to convince you to buy only their homes at the highest price. Your Exclusive Buyer Agent’s job is to even the odds and negotiate for the lowest price and best terms for YOU!

If you’re building what you buy, you might think, “Why would I need an agent?” However, new construction is a complicated and expensive process. The advantages are many; aside from the obvious ones. The fact that having buyer agent representation is often FREE cannot be repeated often enough. So too, should the misconception that not using a buyer’s agent will save…

June 17, 2023

A jumbo loan is a type of mortgage loan that’s used to finance loans that exceed the conforming loan limit. In the United States, the Federal Housing Finance Agency (FHFA) sets loan limits for conforming loans each year.

If the home you’re purchasing will require you to borrow more than the conforming loan limit (CLL), you’ll need to apply for a jumbo loan. But because of the larger loan amounts and increased risk for lenders, Florida jumbo loans often come with higher interest rates and stricter requirements than conventional loans.

In 2023, the conforming loan limit for most U.S….

June 8, 2023

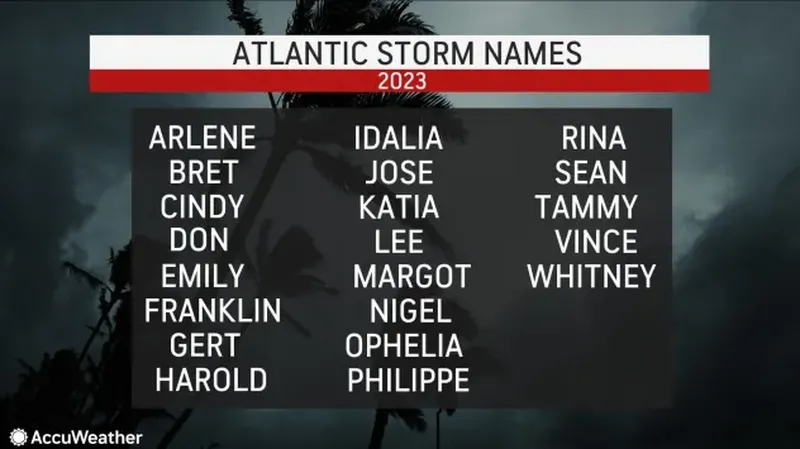

As a Floridian, you already know the drill: hurricane season runs June 1 through November 30 each year, and certain hurricane preparations are needed to protect your home when storms appear to be heading your way. But what happens if you are some distance away, or even out of state, when this occurs? You can still prepare ahead of time – and a few extra steps is all it takes to secure your home while you’re away.

Performing the following hurricane preparation before vacation will allow you to relax and enjoy family time, or the…

March 30, 2023

Think twice about purchasing a home with Polybutylene (PB) pipes. Polybutylene (PB) pipes were widely used in Florida residential construction from 1978 to 1995. Billed as a less expensive alternative to traditional copper pipes, up to 10 million homes across the United States were outfitted with PB piping during this period. Polybutylene pipes tend to degrade over time, creating small fractures and pinhole leaks. Any single fracture could eventually result in sudden failure, which generally ends up causing extensive damage to the home. A class-action lawsuit in 1995 resulted in nearly $1 billion being awarded to affected homeowners…

March 20, 2023

Home automation is increasingly popular as technology improves and devices become more affordable. Smart home automation works by connecting various devices in your home to a central hub or directly to a network. These devices can then be controlled remotely through a smartphone app, voice assistant or web interface.

Smart home components like security or climate control can be integrated with other smart devices, like your home entertainment system. This allows you to create a comprehensive and integrated smart home system that can automate many different tasks.

There are tons of reasons you may want to invest in home automation, but…

February 27, 2023

The National Flood Insurance Program is a pre-disaster flood mitigation and insurance protection program designed to reduce the escalating cost of disasters. The National Flood Insurance Program makes federally backed flood insurance available to residents and business owners. Standard flood insurance by the National Flood Insurance Program generally covers physical damages directly caused by flooding within the limits of the coverage purchased. Private providers may have higher limits or broader coverage compared to National Flood Insurance Program policies.

A flood insurance policy is intended to cover physical damage to your building or personal property “directly” caused by a flood. Flood…

February 6, 2023

Homeowners beware.

With the potential of a recession and rising mortgage rates; lenders are seeing fewer loan applications and many buyers are not able to qualify for legitimate loans. Homeowners are often coerced into using the equity in their homes to pay off debt, finance unexpected expenses and to cover job losses, etc.

Lenders that over promise are likely to be ones to stay away from. If you cannot qualify for a mortgage with a reputable financial institution if is best to wait to purchase a home until you can.

What Is Mortgage Fraud?

Any misrepresentation of information on a home loan application can be…

December 1, 2022

If you’ve been house-hunting in recent years, you’ve really been through it. Maybe you were waiting out the market, hoping the rocketing prices would start to flatten. Now, of course, they have — but between 2021 and 2022, mortgage rates have more than doubled, from less than 3 percent to more than 7 percent.

If you are renting and trying to save for a down-payment, the cost of your rental has likely increased as well.

Sellers who are sitting on low mortgage rates are not listing their homes for sale and supply shortages, cost of land, and cost…

Kim N. Bregman

Kim N. Bregman